Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Welcome to the thrilling world of stocks, where financial possibilities abound and the market is alive with activity. If you’re new to stock trading, don’t worry; in this blog I will give a few tips and share my personal journey navigating through the market. I, too, was once a newcomer attempting to understand the complexity of the stock market. It began as a curiosity, evolved into a passion. I’ve grown to understand the market’s character after learning from both achievements and failures.

As a beginner, understanding the fundamentals is your first step. Stocks represent ownership in a company, and their values fluctuate based on various factors. Think of it as becoming a part-owner of businesses you believe in.

My advice for beginners

In the exciting world of stock market exploration, mistakes are inevitable, especially for newcomers. One common mistake is thinking that it’s a way to make money quickly. It’s crucial to understand that the market’s ups and downs are natural, and attempting to time every peak and trough often leads to disappointment. Another common mistake is underestimating the power of research. Failing to thoroughly investigate a company before investing can result in unforeseen risks. Additionally, emotional decision-making is a treacherous path. Allowing fear or greed to dictate actions can lead to impulsive choices and regret. Lastly, neglecting diversification is also a common mistake. Putting all your funds into a single stock can expose you to unnecessary risks. As a newcomer, learning from these common mistakes are a vital part of the journey toward becoming a successful investor.

Allow me to share some personal victories and lessons learned in my stock market journey. From discovering hidden gems to weathering market storms, each experience shaped my understanding and approach to investing.

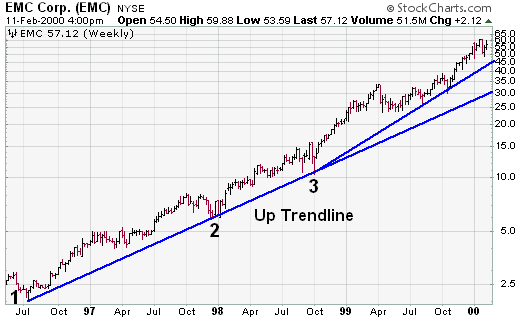

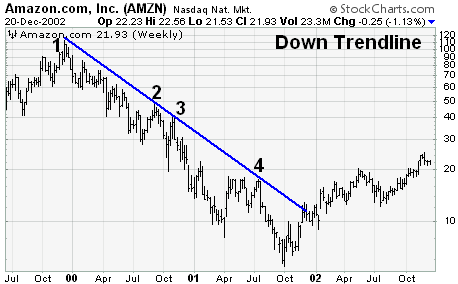

Through the course that I took, I learned the various patterns and trends and how you can use it to navigate the market. For example I learned how to find the trend line of the stock and how to use it to predict the next peak. A trend line is drawing a line on a graph that shows if a stock’s price is going up or down. If the line goes up, it means the stock is generally going higher, and if it goes down, it’s going lower. It helps people see the overall direction of a stock and figure out when it might be a good time to buy or sell. I used a stock market simulator to test the skills I have learned in this journey to see if I was able to apply my skills.

Picture trend lines as your visual roadmap in the stock market journey. When a stock consistently hits higher lows, draw a line connecting those points, revealing an upward trend. Similarly, connecting lower highs indicates a potential downtrend. The magic lies in recognising these trends, offering valuable insights for strategic entry and exit points. Remember, trend lines aren’t just squiggles on a chart; they’re your guide to navigating the market’s twists and turns.

Even though trend lines are helpful, they don’t always work perfectly. Things like big economic events or sudden changes in the market can mess up what the trend lines predict. It’s also important not to only rely on trend lines because that might not give you the full picture of what’s happening in the market.

Another tool that I have learned in this course is moving average. The Moving Average method smoothens out the data, making it easier to see trends. When the stock prices cross above the Moving Average, it’s like catching a wave, suggesting an uptrend, and when they go below, it might mean a downtrend. There are two types of Moving Averages: Simple and Exponential. Using Moving Averages helps you see where the market is heading and when it might change direction.

The Simple Moving Average smooths out the ups and downs, letting you see if a stock is generally rising or falling. When prices cross above, it’s a green light to jump in; below, it’s a caution sign. Add the Exponential Moving Average, which gives extra importance to recent moves. Using both helps you predict where the market might turn next. It’s like having a handy map for your stock adventures!

There are two main types of Moving Averages: Simple Moving Average (SMA) and Exponential Moving Average (EMA). The SMA treats all prices equally, while the EMA gives more weight to recent prices, making it more responsive to market changes. Understanding the difference between them is key to effectively using this method.

While the Moving Average method is a solid tool, it’s not immune to market surprises. Sudden shocks or unexpected events can disrupt its predictions. It’s important to complement this method with other analyses and stay mindful of the ever-changing market conditions.

in conclusion, as you start learning about stocks, using trend lines can help you see where prices might go. Remember, trends are like your friends, but markets can be a bit tricky. Mix trend line stuff with doing your homework and being careful with risks to do well in the stock market adventure!

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.